Short Sale Deficiency Can Help Establish Insolvency and Avoid Income Tax Liability

A short sale occurs when a homeowner sells their home for less than the total remaining balance on their mortgage.

The lender must agree for the sale to take place and will typically forgive the remaining mortgage balance left.

When the debt is forgiven, it creates COD (or Cancellation-of-Debt) income to the homeowner selling the property.

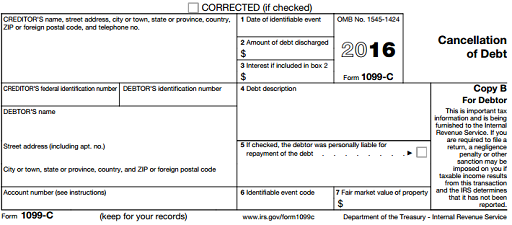

The amount of COD income to the owner is the amount of debt that was forgiven. When you have COD income, the lender will report the amount to you and to the IRS on Form 1099-C. A sample Form 1099-C below.

courtesy of Sain Solutions LLC

Per IRS regulations, the amount of COD income reported in Box 2 of Form 1099-C is taxable and should be included on your annual tax return. However, there are exceptions to having to report COD income as taxable, and one of those exceptions is called insolvency.

Being insolvent simply means your total liabilities are more than your total assets. If your insolvency amount, or the amount that your liabilities exceed your assets, is more than your COD income, then all the COD income is nontaxable. However, if your insolvency amount is less than your COD income, only the portion up to your insolvency amount is nontaxable.

For example, let’s say Joe is going through a short sale. His mortgage balance is $200,000 and his home is selling for $125,000, leaving a deficiency of $75,000. In addition, Joe has $2,000 in his checking account, a 401k of $12,000, a car worth $8,000, and a vehicle loan balance of $25,000.

Joe’s total assets are $147,000 (home + checking account + 401k + car value). Joe’s total liabilities are $225,000 (mortgage + vehicle loan).

Joe’s insolvency amount is $78,000 ($225,000 – $147,000). Since Joe’s insolvency amount is more than his COD income ($75,000), the full amount of COD income is nontaxable.

Establishing insolvency is key for treating COD income as nontaxable. The fact that you are in a short sale can be used to help establish insolvency.

By definition your home in a short sale is valued at less than the mortgage balance. These amounts when used in the insolvency calculation help to prove you were insolvent before the sale.

These are general guidelines regarding COD income and insolvency, however every situation is unique and accordingly careful planning should be administered for each situation.

If you’d like to discuss your particular situation further, please contact our office for a free consultation.